The housing market in and around Scotts Valley can be broken down into three categories: the good, the bad and the ugly.

The good

If you’re looking to buy a home and have a good income and enough cash to make a 20 percent down payment, “there are some screaming deals, particularly in Boulder Creek,” said Scotts Valley Realtor Melanie Useldinger.

“This is a great time to buy,” added David Bergman, another Scotts Valley realtor. “We’ll never see these 1970s-level interest rates again.”

He thinks local housing markets are close to a bottom and expects prices to edge up in 2011.

Santa Cruz Realtor Neal Langholz also sees an opportunity.

“It’s much harder to qualify for a loan than it was a few years ago, but if you can qualify, money is cheap,” he said.

Five years ago, if a buyer was looking for a home in the $600,000 to $1 million range, Langholz says, there might have been three to five homes in the county to show that buyer. Now, there might be 50 to choose from.

The bad

These labels don’t describe people, just the situation they’re in. And if you are trying to sell a house, you might be stuck. Home sales have fallen off a cliff.

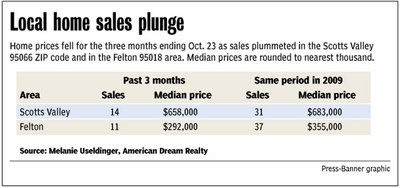

“Shocking” is how Useldinger described the recent plunge in Scotts Valley home sales: just 14 in the past three months, from 31 in the same period a year ago. The same numbers dropped to 11 in Felton from 37 a year earlier.

Buyers have been sitting on their hands, watching as prices drop and then drop more as banks unload foreclosed homes at fire-sale prices.

“Who wants to buy when prices are still dropping?” Useldinger said.

The large number of homes on the market presents a problem for sellers. And Wayne Shaffer, a realtor in Santa Cruz for 38 years, says the true inventory might be understated.

“What’s on the market and what could be on the market are two different things,” he said. “People are holding onto properties because they can’t get their price.”

If prices improve, he expects to see more homes on the market.

The ugly

That describes the situation of homeowners who bought during the bubble years of 2005 through 2007.

Kurt Useldinger, husband of Melanie and also a realtor, works with a lot of homeowners who are in trouble. He cites an example of a person who bought a home for $1 million near the top of the market, pays $7,000 a month on the mortgage and has watched the home’s value drop to $600,000.

“They think the home value is going to come back in a couple of years,” he says, “but there’s just no way. They’ll have to hang in there for 7 to 10 years.”

In cases of that sort, he tries to persuade lenders to agree to a short sale, where the house is sold for less than is owed on it, and the lender allows the homeowner to walk away. Often, banks won’t go along, and foreclose if the homeowner stops making payments, then sell the property for less than is owed and sometimes pursue the former homeowner for the difference.

An alternative is to ask the lender to reduce the amount owed to make the payments more affordable. But Useldinger says that out of 50 families he’s worked with, only three have gotten loan modifications.

“There’s no teeth in President Obama’s Making Home Affordable program,” he said. “The banks are not helping people.”

His advice: Be assertive with your lender, and don’t just wait around hoping for things to improve.

Home prices fell for the three months ending Oct. 23 as sales plummeted in the Scotts Valley 95066 ZIP code and in the Felton 95018 area. Median prices are rounded to nearest thousand.

Mark Rosenberg is an investment consultant for Financial West Group in Scotts Valley, a member of FINRA and SIPC. He can be reached at 831-439-9910 or mr********@*wg.com.