Within a month, property owners in unincorporated Santa Cruz County can expect to hear from the California State Board of Equalization that a $150 bill for a controversial fire protection fee is on its way.

Signed into law by Gov. Jerry Brown on July 7, 2011, as part of Assembly Bill x1 29, the State Responsibility Area Fire Prevention Benefit Fee allows the Board of Equalization to collect an annual payment from property owners to help pay for state-run Cal Fire services.

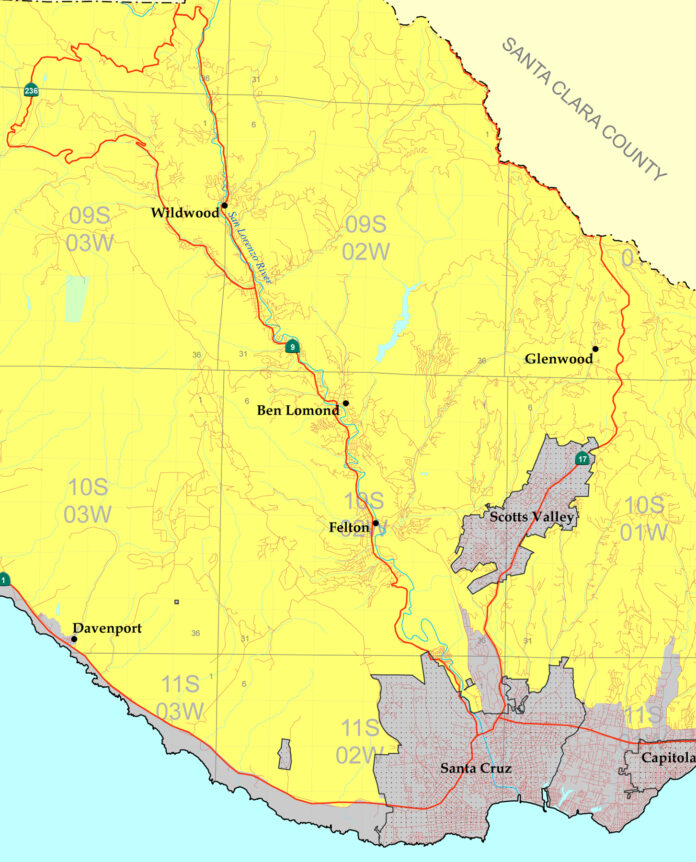

The state responsibility area is anywhere the state of California is financially responsible to prevent and suppress wildfires. Lands within incorporated city boundaries and federally owned lands are not included.

The towns of Felton, Ben Lomond, Bonny Doon and Boulder Creek are all in the state responsibility area.

The law levies a $150 fee on the owner of each habitable building on a parcel within the area. Most local property owners will be eligible for a reduction to $115, however.

Cal Fire makes case for fee

Daniel Berlant, a spokesman for Cal Fire, said the fee applies to about 830,000 residents throughout the state and will raise nearly $90 million in revenue for Cal Fire.

“This fee really is essential,” he said. “It allows us to continue fire-prevention work and services.”

According to Berlant, Cal Fire’s $700 million budget is tied to the state’s general fund, and because of persistent budget overruns, it has recently lost more than 10 percent of that total.

“We’ve made some major reductions because the general fund was cut,” he said. “We’ve seen almost $80 million over the last year and a half cut from our budget.”

Berlant said Cal Fire’s budget forecast predicted more cuts of about the same amount, so that the $90 million expected from state responsibility area fee would simply preserve the status quo.

“These (fees) are just to keep intact current services,” he said. “This is the first time these services have been charged for.”

Revenue from the fee will help pay for fire prevention within the state responsibility area, Berland said, including brush clearance around communities on public lands and along roadways and evacuation routes.

Local impact widespread

About 24,000 property owners in the unincorporated areas of Santa Cruz County — including Felton, Ben Lomond, Brookdale, Zayante, Bonny Doon and parts of Scotts Valley outside the city limits — will be expected to pay the fee, Berlant said.

He added that people whose property is within the cities of Scotts Valley and Santa Cruz are not included, because they are the responsibility of local fire services.

“If (a community is) incorporated, (primary fire-suppression is) not the state’s responsibility,” he said.

Berlant said postcards alerting property owners about the fee would be mailed within a month, with bills scheduled to show up two weeks later.

Property owners within the state responsibility area who are served by local fire protection districts — about 95 percent of those affected in Santa Cruz County, according to Berlant — will receive a break of $35 per habitable structure and owe only $115.

Critics see tax in disguise

The state responsibility area fee has generated much controversy in the year since AB x1 29 was passed.

Most recently, the fee drew a lawsuit from tax advocacy firm The Howard Jarvis Taxpayers Association, which alleged that the fee is a tax increase disguised to sidestep voters.

The original Assembly bill approving the fee was passed with a simple majority vote. California law states that any bills involving tax increases require a two-thirds majority vote.

Fire districts oppose fee

Locally, at least two fire protection district boards have voted to adopt resolutions opposing the fees.

Zayante Fire Protection District Chief John Stipes said he supported Cal Fire, but the fees struck him as suspicious and could have reverberating repercussions.

“My gut feeling is that the fee was illegal,” he said. “They’re calling it fee instead of a tax to bypass voters.

“(The fee) would’ve never flown going through the normal tax channels.”

Stipes, whose five-member board voted to oppose the fee, said it appeared that fee revenue would be used to “close a loophole with the state budget itself” rather than to preserve or expand services.

“We totally support Cal Fire, but the money itself isn’t really going to go where it needs to go,” he said. “(The fee is) another tax that somebody’s going to have to pay.”

Stipes also suggested that communities burdened by state fire prevention fees would be less likely to approve future bond measures to support local fire districts, which could deprive local crews of needed equipment and facilities.

“If (the fees) do, in fact, fly, it will hurt all fire districts in the process,” he said. “You can only tax people so much. At some point, (community revenue) is going to dry up. Our constituents here are going to get sick of it sooner or later.”

Boulder Creek Fire Protection District’s board also voted to oppose the fee.

Chief Stacie Brownlee of Ben Lomond Fire Protection District echoed Stipes’ misgivings.

“I don’t think (the fees are) really going to help Cal Fire, either,” she said.

Brownlee described the fees as a cash grab intended to pay Cal Fire’s administrative costs rather than to bolster crews in the field.

“(The fees are) not going to help us at all, unfortunately,” she said. “If (Cal Fire crews) see any of it, it’ll be in prevention.”

AT A GLANCE

Information on the State Responsibility Area Fire Prevention Benefit Fee and details about the appeals process can be found at www.firepreventionfee.org. An interactive map that demonstrates the areas that fall within state responsibility area boundaries can be found at www.bof.fire.ca.gov/sra_viewer/