The so-called “green rush” has jarred Santa Cruz County, where the value of a retail cannabis license has soared to more than $2 million.

Of the 14 dispensaries in the county, four have changed hands in the last 12 months – Reefside Health Center (formerly Green Acres) in Santa Cruz, Evolution (formerly East Coast Evolution) in Felton, Santa Cruz Mountain Herbs in Los Gatos, and, on Aug. 25, the Central Coast Wellness Center in Ben Lomond. .

“It’s time for the progressive, natural forward motion to take over,” said Bradd Barkan, who said he sold Central Coast Wellness Center for $ 2 million. when?

“I don’t want to play with that huge competition anymore. Mom and Pop shops will be acquired. There’s no stopping it.”

He said one of the other license sold for $2.4 million.

Barkan, who operates California Dreaming Real Estate in Felton with Heidi Hart, paid $125,000 for his cannabis license on Valentine’s Day 2012.

“This is a nice payday,” he said this week.

What’s driving the prices up, according to sellers and lawyers, is the July passage of the Medicinal and Adult-Use Cannabis and Safety Act that allows owners to possess two licenses – medical and recreational – and sell both products at the same location.

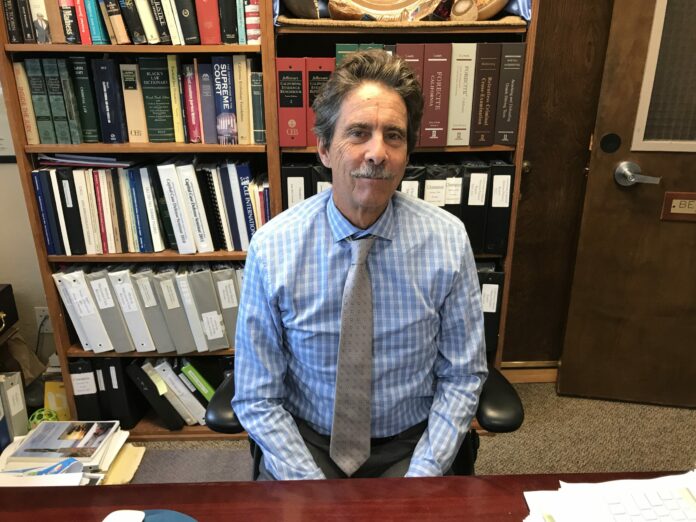

“The new owners will find that they have a chance to double their money,” said local attorney Ben Rice, a recognized expert in state and local cannabis law.

Rice and Barkan didn’t reveal much about the man who last week purchased the Central Coast Wellness Center, except to say he paid cash, and is a billionaire inventor who lives outside the Central Valley in the Sierra Foothills.

“He’s humble,” said Rice, who put the deal together between the buyer and Barkan. “He doesn’t need the money. He sees this as an important part of our country moving forward.”

Under state guidelines, licenses must remain in the county in which they originated, and can only be used where existing zoning allows.

Details about cannabis licenses and their owners are not available to the public, according to Rice.

Jeff Angell, president of Creekside Collective in Boulder Creek, said he has recently received four inquiries into buying his retail license.

“It’s interesting times, indeed,” he said. “If the right offer comes around I’ll do it.”

For now, however, Angell said he enjoys what he does, and feels a high degree of loyalty toward his employees.

Angell added that the only downside of owning a cannabis dispensary is section 280E of the federal tax code. The U.S. government says that marijuana is still a controlled substance, and controlled substances are illegal.

States can do what they want and levy taxes on the expanding industry, but because the federal government still sees it as a controlled substance, itemized deductions are severely limited.

Code section 280E has specific language that states that no deductions are allowed for any amount incurred in a business that consists of trafficking in a controlled substance.

Angell said his margins are radically compromised by this law.

Barkan said he even had a $1.8 million offer fall through once the buyer realized the issues with Internal Revenue Service and the Justice Department.

Barkan adds that the current license-purchasing frenzy began after Proposition 64 was passed last November, which legalizes recreational marijuana Jan. 1, 2018.

“I told everyone to vote against the law,” he said, adding that he is using $900,000 from the sale to complete his purchase of Don Quixote’s International Music Hall, which he will turn into Flynn’s Cabaret and Steakhouse.