“In the world of finance, the best accounting is like poetry—precise, impactful and timeless.” —Daniel Adams

Every New Year, calculate your present resources, income, expenditures and cash flow. Eight accounting classes helped me do financial “dream planning” well while proudly wearing CFP therapist, economist and lawyer hats.

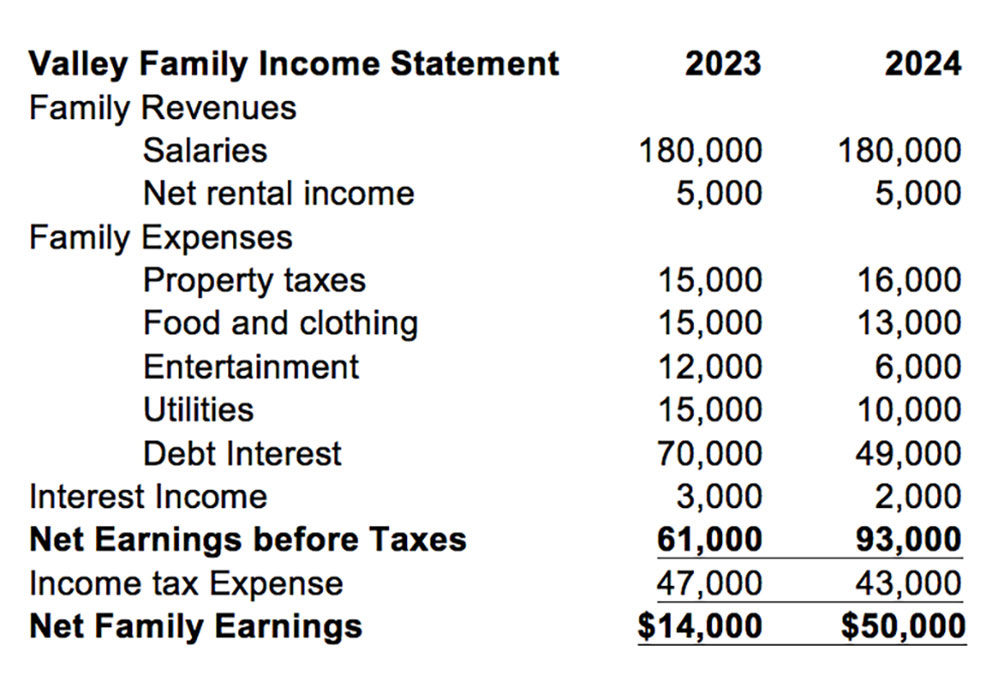

Expect income statements, balance sheets and statements of cash flow not just in business and rental financial statements, but in tax returns, trust documents, loan applications and FAFSA forms. What can your family learn from Personal Financial Statements?

For a given time frame, typically yearly, income statements enumerate all your sources of income: salaries, interest, rental and business, etc. They also show payments for rents, mortgages, food, etc. If income exceeds expenses, you are saving, but if expenses exceed income, you must be begging, borrowing or stealing. The Census Bureau counts median Santa Cruz County family income as $105,000. Know yourself!

Awakened families fill buckets of budgeting with income statements. Operating income comes from ordinary business activities and other income from investments like CD interest. Are we really happy spending 5% of income on Starbucks? If we spend too much on clothing or cars, we must shop less or buy used. If credit card interest is a big budget item, paying off debt should rise as priority.

When interest drops, mortgages can be refinanced, and income analysis can be used to consider reverse mortgages. In 2024, the Scott Valley Income Statement reveals more frugal entertainment expenses with dramatically lower interest, energy and tax payments (with higher mortgage interest deductions and solar credits).

Balance Sheets capture family net worth—assets minus liabilities—at given points in time. As earned income decreases with retirement, net worth is the best predictor of lifestyle options in retirement. Regrettably, Synergos Technologies estimates SC mountain family net worth at $261,684 with roughly half the people owning less than $100K. If you are trapped in debts, make painful payments to avoid bankruptcy, dependency or destitution.

In general, families must retire on 4% of net worth to preserve assets. Homeowners average four times the net worth of renters, who expect high ongoing expenses. “House poor” retirees can relocate or refinance with reverse mortgages to live on. The key is building net worth. After using credit cards for a $20,000 vacation in 2023, the Scott Valley family balance sheet shows fewer CDs, greater emergency funds and a $130,000 home equity loan that paid off credit card and auto debt and bought solar. Their net worth rose from real estate and 401K investments: it measures wealth as BMI measures health.

Statements of Cash flow and FICO scores assess cash flows and credit eligibility stresses like pulses. The Valleys borrowed more for appreciating assets that cut operating expenses (solar and credit card payoff). Cash flow gets divided between “Operating Activities” like wage earning or business, “Investing Activities” like crypto speculation or dividends, and “Financing Activities” which include credit card borrowing or getting Daddy allowances with strings in your life. Valley family Operating cash flow improved with investments and borrowing that lowered interest payments.

Personal Financial Statements organize insurance, investment, retirement and estate planning. Michael Carter rhapsodizes: “Accounting is the art of turning chaos into clarity and confusion into financial wisdom.”

Robert Arne, EA, CFP, MS, of Carpe Diem Financial Life Planning, gives holistic financial advice as his client’s fee-only fiduciary. He serves mostly Santa Cruz Mountain dwellers. These articles must not be read as personal financial, mortgage, tax or investment advice; consult appropriate professionals. Learn more at www.carpediem.financial.