A decision in December by the board of the California pension fund for public employees –CalPERS – to lower its growth expectations has left Scotts Valley and other cities across the state reeling from the prospects of dramatic increases in pension costs.

The surprise announcement by CalPERS also affects school, water and fire districts.

Scotts Valley estimates the CalPERS announcement will increase the city’s annual pension contribution by nearly 70 percent over three years.

In the coming fiscal year, beginning July 1, the city must contribute an additional $313,000 for employee retirement.

And that amount will go up in each of the next three years.

By 2021, the annual pension contributions by the City of Scotts Valley will reach $2.8 million, far more than the $1.5 million currently being paid.

Projected increases over the next 36 months in Scotts Valley will be: $313,000 (2018-2019), $363,000 (2019 – 2020), $457,000 (2020 – 2021).

Those 2021 numbers total more than 16 percent of the city’s entire operating budget.

Scotts Valley pays all pension contributions for CalPERS members hired before 2013.

CalPERS members hired by the city after Jan. 1, 2013 pay 6.25 to 11.5 percent of the contributions to the benefit plan in which they participate. “This is a real blow and it will continue to be a challenge,” said Scotts Valley City Manager Jenny Haruyama.

“It’s bad news. When does it end? I don’t think it’s realistic for cities to carry this kind of challenge.”

The dire situation is the direct result of fallout from unrealistic forecasting by CalPERS. The state public pension system previously estimated a 7.5 percent annual return on its $305 billion in assets. In December it lowered this to 7 percent, which means higher contribution are required to keep the pension fund solvent.

“In reality, this year the largest fund in the country, outside of the federal government, earned less than 1 percent,” said Ted Eliopoulos, the pension fund’s chief investment officer, in a report last summer.

Councilman Jack Dilles worries that CalPERS will again lower its expectations within the next year or so, if its investment continue to underperform, forcing even more increases in contributions.

“This is a zero-sum game,” he said. “Pensions are at risk down the line.”

Statewide, CalPERS manages assets for 1.7 million current and future retirees. By anticipating lower returns, CalPERS forces the state, which is composed of cities, schools, water and fire districts, and, by default, taxpayers, to contribute an additional $2 billion a year for workers.

“This is not a comfortable situation to be in,” said Mayor Randy Johnson.

Dilles, the city’s former finance director, agreed. “It is a big deal,” he said. “This is a lot of money.”

Pension funds pool their money and typically invest in stocks, bonds and real estate. The goal is for the returns to cover at least 80 percent of retiree obligations. Last summer, according to calPERS, returns amounted to 77 percent.

With the CalPERS’ action less than a month old, city financial planners are set to begin examining how to increase pension-contribution payments, while keeping city services in tact.

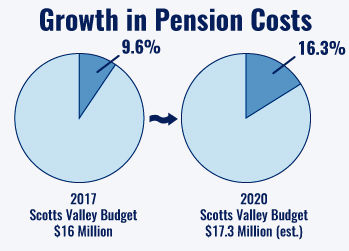

Today, CalPERS’ obligations total 9.6 percent of the city’s $16 million annual budget. By fiscal year 2020-2021, assuming there are no other changes to expenditures, pension contributions will amount to 16.3 percent of the estimated $17.3 million annual budget.

Haruyama said the transit occupancy tax (TOT) will become an important revenue generator.

But impact of tax money from the 1440 Multiversity, and the new Marriott and the Lexington hotels are a ways off. “It could be three years until we see any transit occupancy taxes,” she said. “I’m not sure what the real money will look like and when it will come in.”

In the meantime, all options are on the table, when the city council huddles with Haruyama and financial consultant Steve Toler, hired under contract through June to fill the vacant city finance director position.

“The council has to think forward,” she said, adding that property and sales tax are the two primary sources of revenue.

Johnson was candid in his assessment of the crisis.

“Taxpayers are the last line of defense for this unsustainable system,” he said, referring to a possible tax hike. “My gut level tells me in Scotts Valley we are willing to pay for services.”

One option, Haruyama said, is to extend Measure U, which provides about $1.1 million in annual revenue. Approved in 2013 by three-quarters of city residents, Measure U levied a half-cent sales tax over eight years for city services. The tax expires in 2021.

Haruyama said the city expects the preliminary budget and five-year financial plan to be published and discussed in a public study session with the city council this spring.