Our country contemplates late Spring with a hundred thousand of us turning to leaves of grass. In the San Lorenzo and Scotts Valleys, the lady in ACE pleads for patience with COVID waiting lines; Americans tolerate one-way signs in store aisles; Felton rental truck employees refuse good work; and the Boulder Creek hair stylist sues the state to reopen. Labor Day celebrations and protests in crowds show massive impatience—but haven’t led to mass outbreaks of disease. High unemployment payments, food stamps, and closed schools discourage the work most want even when workplaces and Chambers can open. Viral regulations to disperse crowds make business inefficient when operational: distancing and extra cleanup reduce store capacities. Short unexpected contagion, Americans must return to work before government follows business to bankruptcy. Republicans play cards for chance while Democrats play for caution; both reward special interests as they gamble elections on life and death.

As a Ben Lomond homeowner and landlord currently selling a house for triple its price—and refinancing others–I felt compelled to look at real estate I know well from a financial planning career encouraging real estate investments. Bay Area housing supply is artificially limited by zoning to preserve abundant water and parkland, restrictions on multifloored development and building codes that dramatically raise construction costs–yet tech housing demand keeps increasing. Thus local realtor Cheryl Hinchman said sales were “Going like guns until the virus hit.”

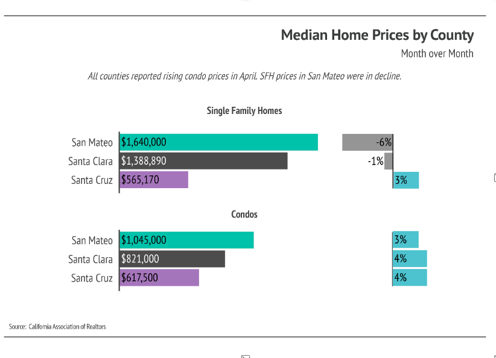

In March, the market paused as nervous homeowners hesitated to welcome buyers who might be sick and buyers feared falling prices. KPIX reports that: “the number of new listings went from around 1,800 to less than 800.” Construction was frequently delayed by jobsite closures and foreign supply chains at risk. Yet high tech workers can take jobs home so the Bay Area is less vulnerable to job losses. Realtors have largely adjusted to COVID conditions with online technology like Redfin and Zillow; “We are all using Zoom”, reports Cheryl, who notes rising Santa Cruz housing prices. Perhaps the virus’s stimulus of cyberwork favors our woods and beaches and may make Frank Lloyd Wright’s dream of dispersed living viable?

Despite eviction moratoria, about 80 percent of tenants made full or partial payments during the first week of May…according to a new survey of 11.4 million apartments by the National Multi-family Housing Council. When tenants can’t or don’t pay rent, their landlords get hit with mortgage bills and repair costs but have no income or economic certainty. California Senate Bill SB 39 now threatens state-wide moratoria on the eviction of commercial tenants adversely affected by Covid-19 until ninety days after Governor Newsom lifts the State of Emergency. The California Business Properties Association fears “financial collapse” from this unconstitutional measure but the bill’s proponents believe moratoria will save small businesses. Threats of residential rent forbearance, rent control and Prop 13 limitations on tax may, paradoxically, discourage rental housing supply and increase rents faster than prices.

House sales are considered “essential services” by the US Department of Homeland Security and mortgage brokers, frequently working from home, generally did not shut down. The California Association of Realtors advised realtors not to hold open houses and to do virtual tours; realtors must tour pairs of buyers in time-consuming multiple showings of vacant houses. CAR requires realtors to use a “Corionavirus Property Entry Advisory and Declaration” which orders sellers to clean the property after each visitation and prospective buyers to represent that they haven’t knowingly been in contact with COVID-19 carriers and don’t have symptoms.

The California Association of Realtors, which forecasts economic growth and growth of both prices and sales of housing, states: “…mortgage rates fell to an all-time low level of just 3.13%.” Local mortgage broker Jeri Skipper writes: “With the US debt rising rapidly because of all the monetary stimulus helping American cope with STAY AT HOME, We should see rates low for quite some time.” The Mortgage Bankers Association stated that May refinances are still up 201% over the previous year. Yet lenders in uncertain markets have tightened borrowing requirements just as consumers run their equity lines higher and seek cash out at risk of default. Jeri Skipper states: “The borrowers with low loan to value and high credit scores and great income to debt ratios get the best rates we all hear about on TV and the radio.” If a Felton resident can refi a modest $600k home at 1% lower interest, it would reduce monthly payments by about $300—so existing homeowners may be the greatest beneficiaries of the virus!

President Trump, who had mailed checks to Americans and announced a moratorium on Fannie Mae/Freddie Mac foreclosures now has demanded that churches and businesses reopen in cautious blue states like ours. With 733 viral cases pending and six deaths, Governor Newsom finally allowed Santa Cruz County to move to phase three of reopening: bars, gyms and hotels may welcome customers, including tourists. Certainly many businesses will race out of the starting barriers when government steps aside, but additional private and public debt service with future taxation will slow growth long term.

Realtors can always find reasons to sell or to buy—and it is hard to imagine both are good at any time. Sellers won’t face the price disaster they feared most, but buying into or holding onto real estate still seems like the sound investment only long run. When fear passes, buyers return. With cyber demand, artificially restricted housing supplies and youngsters approaching marriage, long term housing prices and rents are likely to keep drifting upwards. Over the centuries, humans have adapted to so many changing circumstances with better and better targeted responses; why should this be the exception?